Cloud accounting software has become all the rage the last few years. But what is it? Desktop based accounting software has been around for decades, but it has its downsides, namely having to update and maintain all your data by yourself. If you haven't made the switch to Cloud accounting software yet, there are some significant benefits that you need to know about.

Making Tax Digital - What does it mean for me?

Making Tax Digital is a key part of the Government’s plan to bring about the ‘end of the tax return’.

If you are VAT-registered, then you are already required to use Cloud accounting software. As a business owner looking after your accounts, the use of Cloud accounting software will help save time and money when submitting VAT Returns to HMRC. It will also ensure you stay compliant with the law.

The Government is also planning on introducing Making Tax Digital for Income Tax. ‘Self-employed businesses and landlords with annual business or property income above £10,000 will need to follow rules for Making Tax Digital for Income Tax from 6th April 2024’. Digital records will need to be kept using Cloud accounting software that is compatible with Making Tax Digital. Quarterly updates will need to be sent to HM Revenue and Customs (HMRC) showing records of all income and expenditure, as well as an end of year report showing a summary for the year. It is important that these measures are in place ready for the 6th April 2024, to avoid any last minute issues.

Is my financial data secure?

Security is one of the biggest concerns when it comes to accounting software. Cloud accounting software companies ensure that all your information is stored securely in the cloud, using similar security that is used by banks for online banking. Your progress is saved, automatically, as you are going along, saving the need to perform time-consuming backups of your information. Regular checks are performed by professionals to ensure that information is as secure as possible and there is no risk of data being leaked.

With most software companies you are required to set up an additional layer of security when setting up your account, in addition to your email and password. This is usually in the form of an access code that is sent to your mobile phone that will need to be entered to be able to log into your account. This ensures that your account is as secure as possible and nobody else can access your financial data.

Will it save me money?

Upgrading to Cloud accounting software will save your business time and money in the long run. Cloud accounting software is based in the cloud, so there are no additional costs for businesses, other than the monthly subscription. There are no extra costs for hosting or maintenance, and software updates are performed automatically, so you are always working on the latest version of the software.

What can cloud accounting software do for me?

Log in from anywhere

Business information kept on Cloud accounting software is all stored in the cloud. This means you have the freedom to log on at any time, from any place, as long as you have internet access. You can log in through a web browser on your computer, or laptop, and for most software providers you can access your information through their mobile app. The advantage of this is that it allows you to work more flexibly - from home, on the train, or even on holiday. It also makes it easier to share data with additional users, such as employees, accountants, or tax advisors.

Real-time information

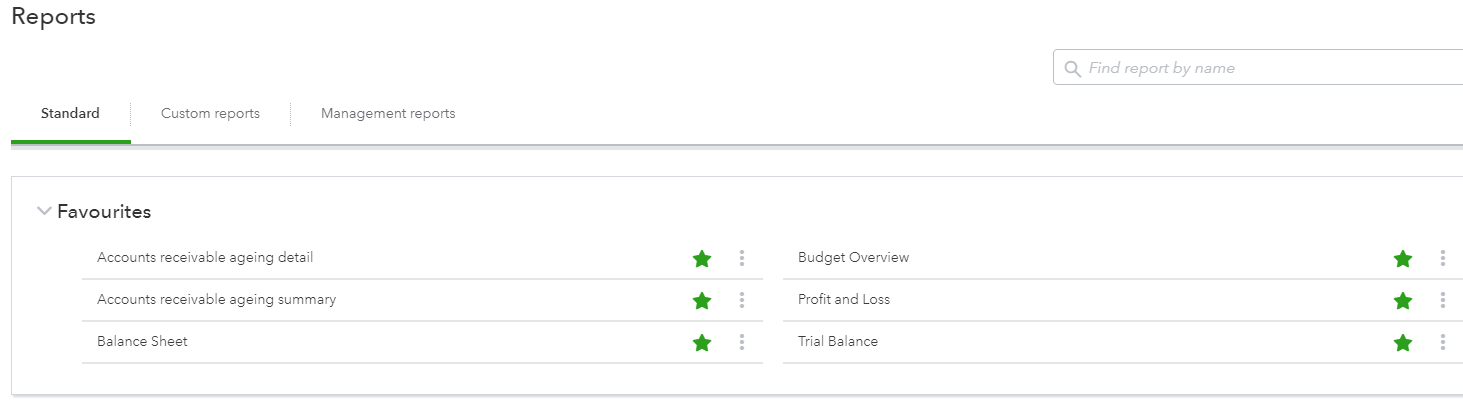

Most Cloud accounting software has access to hundreds of different reports which can be tailored to meet individual and business needs in real-time. If bookkeeping is kept up to date, then these reports can provide up-to-date financial information for businesses. They can be used to make financial decisions and can help when applying for business loans or mortgages. From these reports, you can drill down further to see where the business is spending money, and perhaps where the business could cut costs to help increase profits.

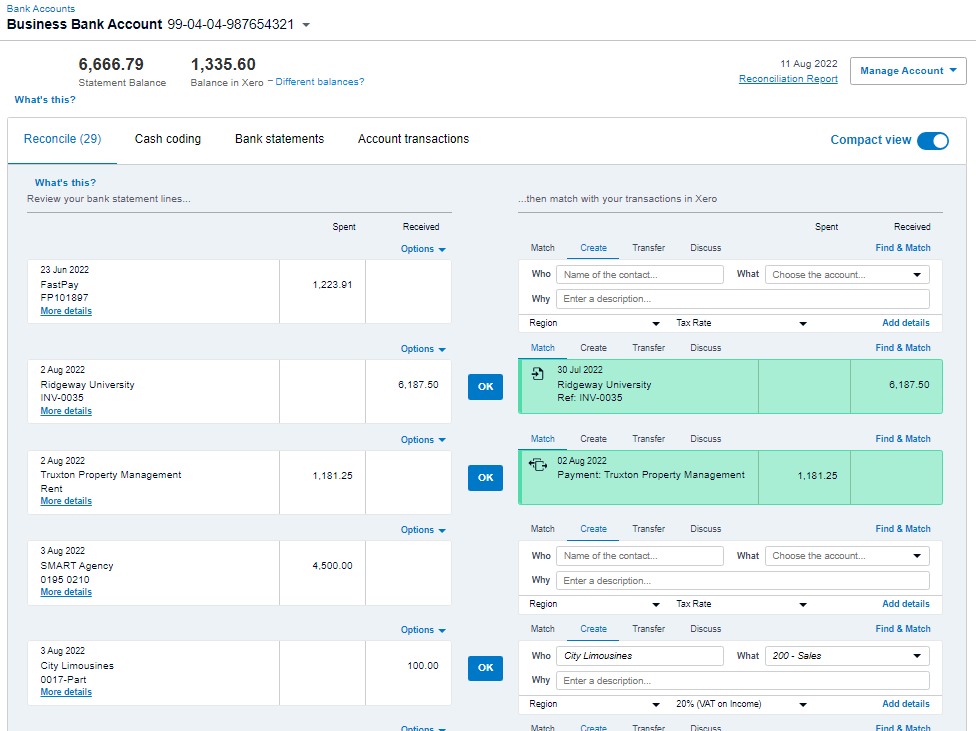

Save time with bank feeds

Bank feeds give you the ability to link your online banking directly with your accounting software, importing transactions from your bank account directly onto your screen. This saves having to import your bank statements, or even manually post banking transactions onto your accounting software. You cannot make any bank payments or change any account details within the software, which is most people’s biggest concern when it comes to setting up bank feeds, especially when there are multiple different users with access to the software.

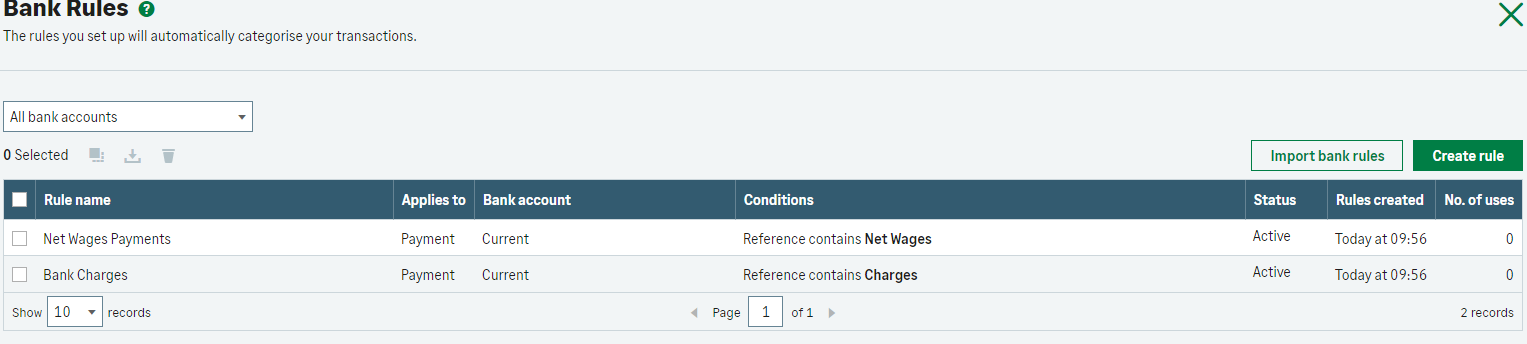

Save time with bank rules

Bank rules are one of my favourite features of Cloud accounting software as they save me the most time when it comes to posting clients’ bank transactions while doing their bookkeeping. Bank rules are set up to automatically post transactions on your accounting software that occur frequently, such as bank charges, loan repayments, wages payments, and payments made to HMRC. They are set up to recognise conditions within the description on the bank statement to help decide where to post these in the software. If you have more than one bank account, you can also set up bank rules to post the transfers between the different accounts. This saves a lot of time and reduces the risks of human error.

Mobile Apps

The introduction of mobile apps has revolutionised the way in which information can be processed, as this allows you to create and send invoices, snap pictures of receipts, and reconcile your bank accounts, all from your phone. This is a huge advantage for people who are always out and about and prefer to send invoices to their customers as soon as the work is completed. It also makes it easier for people to quickly log on to see who owes them money, and to who they owe money, which will help businesses to run smoothly and more efficiently.

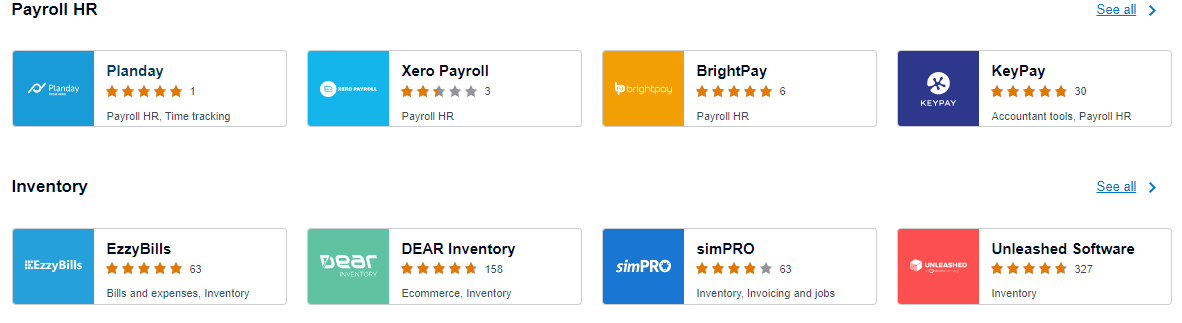

Supporting Apps

Many Cloud accounting software companies give their users the opportunity to integrate their system with supporting apps to help them with the day-to-day running of their business. There are apps that can help with cash flow, inventory, payroll, invoicing, collecting payments, time tracking, and many more. These apps usually come with an additional cost but can help improve the internal processes and growth of a business.

Sales Invoicing

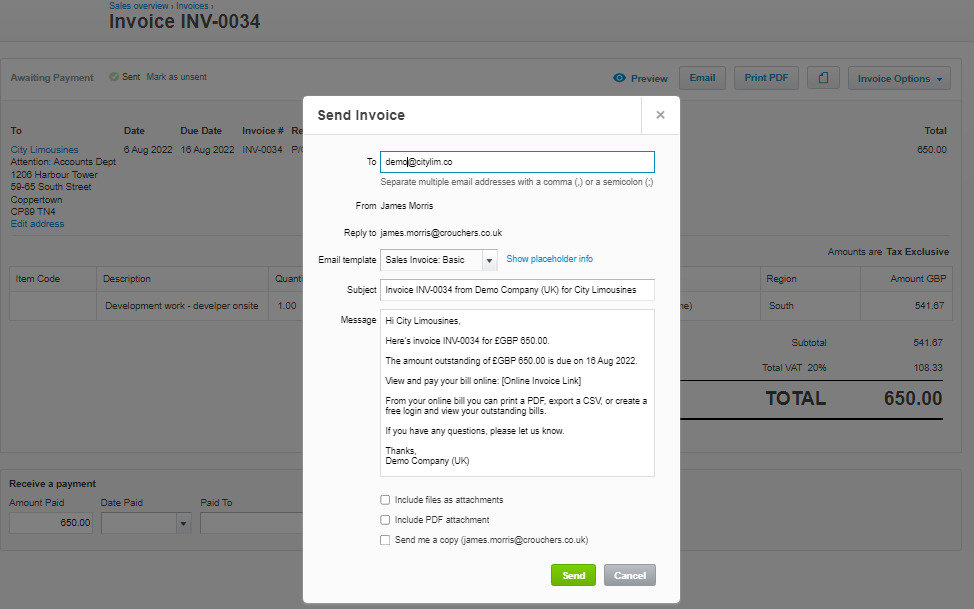

Another one of my favourite features of Cloud accounting software is how easy it is to create and send sales invoices to customers. Cloud accounting software makes it easy to customise your sales invoices template and allow you to change the colours on the invoice, adjust the font, add payment details, and make sure that all the correct information is included. Cloud accounting software also makes it easy to send invoices to your customers. Once you have raised an invoice you will get the option to email this invoice to your customer from within the software. You can also add an option to track the invoices and see when your customer has viewed the invoice that you have sent them. All of this is designed to make it as easy as possible to invoice your customers, which will hopefully reduce the time it takes for businesses to be paid.

The rise of Cloud Accounting Software

Cloud accounting software has become increasingly popular in the last few years and will continue to grow with the introduction of Making Tax Digital for Income Tax. With the rise in Cloud Accounting software, time has been made available to business owners to help grow their business instead of being bogged down in admin. As Cloud accounting software becomes more popular the software will adapt and develop to help businesses become even more efficient.